Scroll Down to Download an Excel Spreadsheet and Google Sheet)

TL;DR: Get your free BRRRR spreadsheet calculator (Excel & Google Sheets) to quickly analyze rental deals, project ROI, and calculate cash-out refi outcomes using real numbers.

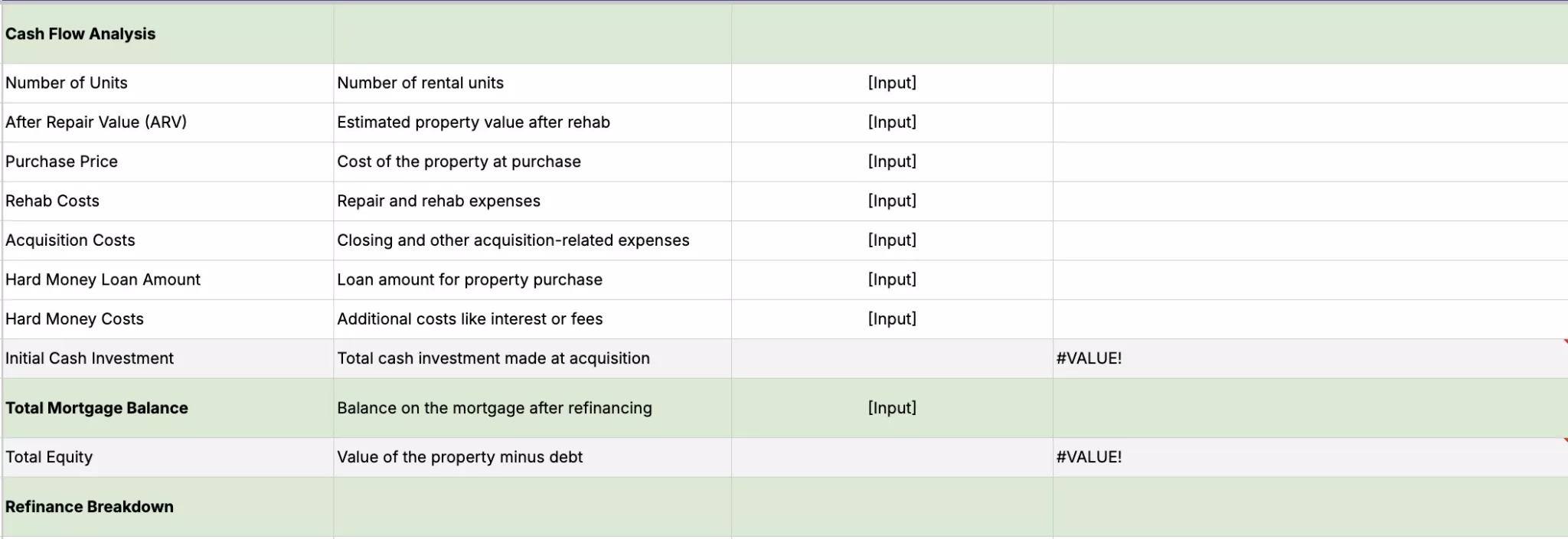

If you’re looking to invest using the BRRRR method, I have a downloadable spreadsheet you can use for free. Most BRRRR investors rely on rough napkin math—and that’s often where the losses begin. I created this free spreadsheet to instantly show monthly cash flow, ROI, and equity potential on any BRRRR deal. It includes built-in calculators for closing costs, net operating income, and your refinance cash-out. For a broader view of ongoing expenses, check out our rental property expense worksheet. Looking for more tools? Browse our full collection of real estate templates and spreadsheets to simplify every part of your investing journey.

Download the BRRRR Spreadsheet (Free)

How Do I Calculate BRRRR in Excel?

You can calculate the numbers for a brrrr property in Excel or Google Sheets by setting up formulas for each step of the brrrr method. This includes fields for purchase price, rehab costs, After Repair Value (ARV), refinance details, and cash flow projections. Our free template has all these formulas built-in to save you time and prevent manual errors when evaluating an investment property.

The key with doing the BRRRR strategy correctly is you want to buy it in a condition that needs a lot of work. The worse the condition, the better the BRRRR strategy is going to work because you can add value and force value instantly.

0:01 today’s video i’m going to show you how 0:03 to buy your first rental property using 0:05 the burst strategy the burst strategy is 0:07 one of my favorite way to buy long-term 0:09 rental property and let me tell you why 0:11 one i can buy the property and i can add 0:13 value and force value and get sweat 0:15 equity instantly the moment i’m done 0:17 rehabbing the property number two my 0:19 mortgage is usually lower and i usually 0:21 get better cash flow because the 0:22 mortgage is lower and of course when 0:24 owning these property you got i get 0:26 right off i get cash flow and i get to 0:28 have appreciation this is strategy when 0:30 you learn how to master this it is the 0:32 bomb baby let me explain all right you Requirements 0:34 guys i’m going to show you guys how to 0:36 buy your first rental property using the 0:38 burst strategy and the requirement is 0:40 going to take to actually do the burst 0:41 strategy okay one i’m gonna share with 0:43 you what the burst strategy actually 0:45 means two the requirement on what 0:47 actually take to do it right and 0:49 successfully and then three what type of 0:51 people you need to have in your team to 0:52 do this right and then lastly i’m gonna 0:54 share with you a real life example of a 0:56 rental property i use a burst strategy 0:57 on so let’s get started baby so here’s 0:59 the requirement what you’re gonna need 1:01 to do the burst strategy now i’m gonna 1:04 go a lot more in depth okay a little bit 1:06 further down this video on this whole 1:08 requirement but for now here’s what 1:10 you’re gonna need number one you’re 1:11 gonna need good credit so later on when 1:13 you refi into permanent financing you’re 1:16 gonna need good credit and you need at 1:17 least 620 or higher the higher your 1:20 credit score is the better your interest 1:22 rate’s gonna be just remember that okay 1:24 now the other thing you’re gonna need is 1:26 you’re gonna need at least two years of 1:28 work history at the same place you can 1:30 be self-employed with the same place or 1:32 you can work for someone but it has to 1:33 be at least two years on your tax return 1:35 that show you’ve been actually working 1:37 at the same place for at least two years 1:38 okay the third thing you’re gonna need 1:40 is when you do your rehab your purchase 1:43 price and your rehab what i call all in 1:46 number you are in number has to be at 1:48 least 65 1:50 to 70 1:52 of the arv 1:54 set for after repair value so i’m going 1:57 to use an easy example if your arv is a 1:59 million dollar you’re going to need to 2:01 be all in at 650 or 700 000 because you 2:05 need at least 25 to 30 percent equity in 2:09 the deal in order to diverse strategy 2:11 and get your original dolphin back in 2:13 your pocket and all this is gonna make a 2:15 lot more sense once i go through the 2:17 burst strategy with you guys later on 2:19 this video so now you gotta put a team 2:21 together in order for you to do the 2:23 birth strategy the first person on your 2:25 team is you gotta be the person who 2:27 actually had to go find the deal either 2:29 you’re gonna have to find the deal like 2:30 for me i actually go out there and i 2:32 look for deal myself if you got time you 2:34 can find yourself by you driving around 2:37 you see ugly houses how they need a lot 2:38 of work you can actually write letters 2:40 to those people you can do unlock the 2:42 people you can call them ask them do you 2:43 want to sell if you don’t have time to 2:46 do all that you can find a whole seller 2:48 someone who actually go do those and 2:50 then they will tie it up and they’ll 2:51 sell it to you they make a little bit of 2:53 profit on that so you’re not gonna get 2:54 the best best deal if you do it yourself 2:56 versus you hiring you know not you don’t 2:58 hire a wholesaler the whole seller’s 2:59 gonna do it themselves but then they 3:01 they look for investor they can sell the 3:02 deal too now you can find wholesaler by 3:05 if you go on social media you say hey 3:07 i’m looking to buy a deal anyone out 3:09 there is a wholesaler send me these 3:10 deals in this era i’m looking for tell 3:12 them what you want or there’s a lot of 3:14 online investment club or social media 3:17 club where you can actually go and tell 3:18 them hey i’m an investor i’m looking for 3:20 this type of deal this type of condition 3:22 and then you got a wholesaler out there 3:24 send me deals or you can actually have a 3:26 realtor find you fixer-upper on the mls 3:30 sometimes you will find deal on mls the 3:32 challenge is when there are fictional 3:34 mls there’s a lot of investors looking 3:36 for deals on there and so what happened 3:38 is that they get multiple offer and they 3:40 get albeit and then those deals it don’t 3:42 become deal no more but there’s time 3:44 when you do find them out there okay 3:46 other thing you can do is more advanced 3:48 i’ve seen a lot of investor hire what 3:50 they call virtual assistant and they 3:51 actually these virtual assistants go out 3:53 there and they find a deal by calling 3:55 and marketing two people and then they 3:57 basically bring it back to you like for 3:59 example we have va’s that go find a deal 4:00 for us also so these are just some ways 4:02 how to find deals the second person you 4:04 need on your team is a general 4:06 contractor in order to find a good 4:08 general contractor you gotta talk to 4:10 other investors who hopefully somebody 4:12 you know that have worked with general 4:14 contractor a few projects and they’ve 4:16 been reliable and they’re reasonable in 4:18 price then you get referral from your 4:20 friend or investor friend i’ve done it 4:22 those are the best referrals another way 4:24 to do it is actually again you go to the 4:26 real estate facebook clubs or sometimes 4:28 they’ll do it live you can talk to 4:30 people there and ask them who they use 4:32 for contractor right or sometime 4:34 contractor are in these clubs on social 4:36 media or live and you can meet them but 4:39 if you haven’t seen their work you might 4:40 want to check reference to see how well 4:42 they did how reliable they are or you 4:44 got to go out there and check and look 4:45 at their project and see how they’re 4:46 done the third thing you can do is you 4:48 can find them on angie’s list and read 4:50 the reviews on them if they get a lot of 4:52 reviews and those are the people you 4:53 want to hire a general contractor the 4:56 third person on your team is a hard 4:57 money lender harmony and lender are 5:00 basically private lenders that will lend 5:02 money to rehab houses they don’t really 5:04 care about your credit as long as you 5:06 have typically 10 to 20 down based on 5:09 your experience and you have some 5:11 experience of rehabbing houses or at 5:12 least your contractor have experience we 5:14 have how they’ll lend you the money how 5:16 you find a harmony lender is very 5:18 similar how you find a general contract 5:19 and the fourth person you want on your 5:21 team is a traditional lender traditional 5:23 lender are the typical lender that’s 5:25 going to basically lend you the money so 5:27 you can do a 30-year fix because harmony 5:29 and lender they do short-term lending 5:31 once you refine your house out of 5:33 harmony lending you need to put in 5:35 traditional lending like the 30-year 5:36 loan you need the traditional lender 5:38 these lenders they want at least 620 5:41 credit score and higher than one two 5:42 year of working history at the same job 5:44 if you want most or all of your original 5:48 down payment back in your pocket when 5:50 you refinance your permanent financing 5:52 you’re gonna need to make sure you’re 5:54 all in number is 65 to 70 percent all in 5:58 of your arv arv is after repair value 6:01 you run at least 65 to 70 all in or 25 6:05 to 30 6:06 margin in these deal and that’s how 6:08 you’re gonna be able to get a lot of 6:09 your original down payment or all of it 6:11 back in your pocket when you re-fight 6:12 your permanent financing now that you 6:14 know what you need and who you need on 6:16 your team so let’s go over the burst 6:19 strategy and what it is and how to do it 6:21 the right way so let’s hear what the 6:23 burst strategy actually mean so b stand 6:26 for buy it now the key with doing the 6:29 burst strategy correctly is you want to 6:31 buy it in the condition i need a lot of 6:33 work a lot of people buy the property 6:35 that don’t need a lot of work the key is 6:37 you want to buy the property in a really 6:39 bad condition the worse the condition 6:41 the better the burst strategy is going 6:43 to work okay r stand for renovated the 6:46 second r stand for rent it out then the 6:49 next r stand for refinance it and then 6:52 the last r stand for repeat the process 6:55 and i’m going to explain this whole 6:56 process on a real deal i bought recently 6:59 using the burst strategy let me explain BRRRR Explained 7:01 the burst strategy in detail because 7:03 when i watch people that watch my video 7:06 they explain burr totally different and 7:08 then sometimes they buy property and 7:10 they go that i just did a burr and i say 7:12 to myself they didn’t burr you just 7:14 bought a rental property and you just 7:16 actually rented it you didn’t even rehab 7:18 the property so let me explain to you in 7:20 detail how it works so the bees stand 7:23 for again buy it and the key here is you 7:25 gotta buy the property in a fixer 7:28 condition form you can buy a property in 7:31 what i call a good condition move in 7:33 ready to go or you can buy a fixer to me 7:35 when you buy a property already clean 7:38 move in then you just buy it and you 7:40 don’t do nothing to it you rent it out 7:42 you can do that all that is you’re just 7:44 buying what i call a rental property but 7:46 when you hear somebody use the word burr 7:48 the biggest reason why they use it with 7:50 burr is this they buy the property as a 7:53 fixer and then they rehab the property 7:55 and after they rehab the property they 7:57 make our property worth as much as a 7:59 property that’s already cleaned that way 8:01 we have instant equity so the key when 8:04 you hear people say the burst strategy 8:06 you know they actually bought as a fixer 8:08 and they rehabbed it and they got 8:09 instant sweat equity in the deal make 8:11 sense the first r is renovation when you Renovation 8:14 buy the property especially the burst 8:15 strategy you gotta renovate that’s the 8:17 difference some people buy properties 8:18 already in good condition they don’t 8:19 have to renovate they buy it and turn it 8:21 into rental right away the only 8:22 difference is they don’t have sweat 8:23 equity why i like to do the burst 8:25 strategy is i don’t mind going in 8:27 rehabbing it and then actually build 8:29 sweat equity through the house redone 8:31 the house is worth more than i actually 8:33 bought it for key with doing the burst 8:34 strategy is you gotta learn how to add 8:37 value and force value what does that 8:38 mean add value is you rehab what’s 8:41 already existing so let’s say it’s a 8:42 three bedroom two bath one level house 8:44 and it’s super dated or near it’s a 8:45 major fixer adam bay you just three 8:47 bedroom two bath what’s already there 8:49 forcing value is you actually finish out 8:52 something for example forcing by you is 8:53 buying a house a three bedroom two bath 8:55 and there’s an unfinished basement what 8:56 you do is you finish up the basement so 8:58 you get more square footage more better 8:59 bathroom now you’re gonna make the house 9:01 worth a lot more money especially if the 9:02 upstair is a fixer so i like to buy a 9:05 property where i like to add value we 9:07 have upstairs for example and then force 9:10 vibe which is adding a little better 9:11 back downstairs make it look new it’s 9:12 about the end of the day all right i 9:14 have a whole new house that’ll be my 9:16 upstairs and adam will bend down 9:18 downstairs that means that thing is 9:19 worth a lot more money when i’m done 9:21 with it and that’s how you can actually 9:23 do the burst strategy and you can get 20 9:25 25 30 margin you can’t get no margin if 9:28 you buy the property already in good 9:29 condition that’s the between a burst 9:31 strategy property versus buying 9:32 something already done and clean rental 9:34 property second r stand for rent all Rent 9:37 right the second r stand for rent after 9:39 you renovate the property they look all 9:41 nice then you got to go out there and 9:43 find a renter for it now for me i 9:45 actually have a property manager to 9:47 actually manage it for me now before i 9:50 had 15 property my wife and i we 9:53 actually manage it ourself so we 9:55 actually went out there and learned how 9:56 to do at the beginning i think it’s good 9:58 that anyone who actually owned rental 9:59 they should at least try to rent it 10:01 themselves for the first one or two 10:02 property maybe three that way you 10:03 understand how to actually you know run 10:06 ads how to screen your tenants how to 10:08 manage the property how to pay the bills 10:10 you need to know that the ins and out of 10:12 being a property manager and that way by 10:14 the time you turn it over to the 10:16 property manager they can’t really sell 10:18 you on something they do or don’t do 10:20 because you know oh that don’t work oh 10:22 that worked so for us when we had 15 10:24 rental property we knew certain things 10:26 we did as effective and then certain 10:27 time we handled the property manager 10:29 they were trying to tell me they’re 10:30 going to do this and this this i 10:31 actually said to them why that’s just a 10:33 waste of time and money why should i pay 10:34 spent money on that and they couldn’t 10:36 argue with that i ran it we managed the 10:38 first 15 property ourself okay now today 10:41 i have a property manager they manage it 10:42 for us where they rent the and where 10:44 they run the ad we run ads in craigslist 10:47 craigslist is actually a great place to 10:49 run ads literally 10:51 most people own uh rental property even 10:53 apart building they rent it on 10:55 craigslist the other place we put it on 10:57 mls and we also put on trulia okay and 10:59 of course my social media page so 11:02 craigslist probably does the most the 11:04 rest of the stuff is bonus we rent it 11:06 out that way that’s how we find a tenant 11:07 now for me my property manager they 11:09 screen everybody what they do is they 11:11 try to get at least 18 month lease we 11:14 used to do 12 months but we realized 11:16 it’s actually better to do 18 months 11:18 because if you ran it let’s say in 11:20 january it comes around january and 11:22 hopefully you don’t rent it on the bad 11:24 time you read in december coming around 11:25 december and you’re going to go vacant 11:26 then you’re vacant in december which is 11:28 the worst time to rent your property out 11:29 so it’s always better to do 18 months 11:31 you can get it we charge first last and 11:33 deposit the biggest thing i’m gonna tell 11:35 you right now and i told this to 11:36 somebody the other day if you’re gonna 11:38 rent the house out you don’t do nobody a 11:40 favor if they can’t come over first last 11:42 in deposit and they get really really 11:44 bad history of being a renter as much as 11:47 they give you the sad story if you don’t 11:49 want to have bad experience being a 11:50 landlord just don’t rent to them because 11:52 the moment you do my favorite and the 11:54 don’t turn out well you guys you 11:56 guys gonna get very disappointed mad at 11:58 them imagine yourself actually doing it 12:00 i got a problematic to do all that but 12:02 if you’re gonna manage yourself do the 12:04 same thing and that’s where i have a 12:06 property manager i let them deal with it 12:08 and then that’s where we rent and find 12:09 tenant the next r is refinance for a lot Refinance 12:12 of you don’t know when you do the burst 12:14 strategy a lot of traditional lender 12:16 will not finance this home because they 12:17 have way too much work order the only 12:19 person that can lend on these homes are 12:20 harming lending and harmony lending what 12:23 they require when you buy a fixer-upper 12:25 is that if they’re gonna land on it they 12:27 want you to put at least 20 down unless 12:29 you get a lot of experience like me okay 12:31 what they will do is this let’s say you 12:33 buy a property four hundred thousand and 12:34 it costs fifty thousand dollar rehab 12:36 that’s 450 they want you to put 20 down 12:39 which is 90 000 and then they will lend 12:41 you the rest of the money to closing the 12:42 deal and to rehab the property after you 12:45 basically finish renovating and finding 12:47 a renter then when you get done then you 12:50 want to refinance out of this short term 12:52 high interest rate hardware lender 12:54 lending into permanent financing you 12:56 want the 30-year fix you want to refi 12:59 get the 30-year parking and write it out 13:01 in order for you to do that you got to 13:02 go talk to a regular lender and then 13:04 they would refinance you out of hard 13:06 money and put you into a 30-year fix in 13:08 a moment i’m gonna show you a real deal 13:10 where i bought a property using the 13:12 burst strategy am i doing it right you 13:14 guys i got my original down payment with 13:17 that ninety thousand i’m talking about 13:18 in this example back in my pocket so i 13:20 have no money vested in this deal and 13:22 the last r is repeat the process the 13:25 last r is repeat the process everything 13:28 i explained to you and you do it right 13:30 you get the original down payment you 13:32 take that money and you go do this whole 13:33 thing all over again and if you do this 13:35 right and you can get a house done 13:37 within six months for example you can do 13:39 two bur in one year with the exact same 13:43 down payment let me show you a real live Example 13:45 example let me break down the number 13:47 when i pay for this property how i 13:48 finance this deal i paid 365 for this 13:51 deal causing the 85 to rehab this house 13:53 when i bought this deal three bedroom 13:54 two bath upstairs and downstairs was a 13:57 unfinished basement in order to actually 13:59 get the most arv you gotta find property 14:02 where you can add value in force value 14:04 since there was nothing in the basement 14:06 we added a one bedroom a full bath and a 14:09 kitchenette downstairs so this house 14:10 became a four bedroom three bath house 14:13 with a second kitchen downstairs for the 14:14 mother-in-law and that’s why right they 14:17 caught 85 000 to rehab i’m all in for 14:19 450 and this is why this bank they 14:22 appraised for 7.25 so after i rehab this 14:25 property i wanted to basically refi out 14:27 of the harmony lending and basically get 14:30 permanent financing 30 years fixed so 14:31 harvard lender wanted 20 down which is 14:34 90 grand okay and then they’ll lend you 14:36 the rest of the money to close in the 14:38 deal and rehab the deal so out of pocket 14:40 is only 90 grand to do this deal edition 14:42 lender says 70 14:44 i’ll give you 70 ltv of 725 which is 507 14:48 and some change i didn’t need all that 14:50 money i just told the bank just give me 14:52 450. if i get 450 if i get a new low for 14:55 450 i can get back my 20 percent which 14:58 is 90 grand and harvard land will get 15:00 back there 80 grand like 80 i mean and 15:03 then everybody’s home i’ll be i’ll be 15:05 i’ll get all my original down payment so 15:07 i got a new loan for 450 dollar which is 15:09 down here i’m going to show you her my 15:11 new lowest 450. the bank appraised for 15:12 7.25 i’m all in for 450 that mean my 15:15 equity in this deal was 275 000 15:19 instant equity that’s 38 margin deal 15:22 that’s a big margin just to give you an 15:24 idea most flipper they do between 10 and 15:27 15 15:28 margin most people do burr they might 15:31 get 15 margin when you have a 30 plus 15:34 percent margin that is rare now it’s not 15:36 rare for me because i know when i do a 15:38 bird i gotta add value and force value 15:41 when i bought this property i said it 15:42 was a three bedroom two bath when i 15:43 finished the basement up it became a 15:45 four bedroom three bath hour with a 15:46 second kitchen you guys see that that’s 15:48 how you get this kind of margin so my 15:50 new loan i only took a level 450 i just 15:53 wanted to be whole okay even though they 15:54 gave me more money i didn’t want more 15:56 money my loan is 450 my mortgage with 15:58 principal tax insurance property manager 16:01 is about 2800 bucks at all including i 16:04 rent the top half of the house out for 16:05 24.25 i rent the mother-in-law 16:08 downstairs for 14.25 so my rent is 38.50 16:12 my mortgage is 2800 that mean i get a 16:14 thousand fifty dollars a month in 16:16 positive cash flow which is twelve 16:17 thousand dollars a year so at the end of 16:20 the day since the bank was willing to 16:22 finance up to seventy percent of the 16:24 number five hundred seven thousand i 16:26 didn’t need all that money i want 450 to 16:27 be whole so i got a little for 450 that 16:30 mean i got my 20 back and hard money got 16:33 there 80 back so when i get my 90 000 16:36 buck you guys i mean i have no money 16:38 invested in this deal i didn’t take any 16:40 of my equity out so i mean i still got 16:41 my 275 with the equity and i get 12 000 16:44 a year in positive cash flow this 16:47 is a full 16:49 burn so when anybody talking about burr 16:51 you guys if you don’t get over 30 you’re 16:53 not going to be basically have no money 16:54 invested so this deal with no money 16:56 vested 275 000 in equity you repeat the 17:00 process you take the 90 grand you do it 17:01 again if it takes you six months to 17:03 rehab let’s say four to six months i 17:05 mean in one year you can do two deal 17:07 with the same 90 000 17:09 that right there is how you grow your 17:11 portfolio okay using the birth strategy 17:13 also so you guys this right here is how 17:16 you do the bird successfully okay that’s 17:18 a wrap for this bird video do me a favor 17:21 like comment and subscribe to the 17:23 channel and i will see you guys next 17:24 video peace out

BRRRR Spreadsheet vs Other Tools

| Tool | Free? | Platform | Best For |

|---|---|---|---|

| This BRRRR Calculator | ✅ | Excel / Google Sheets | Custom deal analysis |

| DealCheck | ✅ | App / Web | Quick comps |

| BiggerPockets | ❌ | Web | New investors |

What’s Included in the BRRRR Calculator?

Our free BRRRR calculator streamlines the property analysis process by breaking down costs, financing, and returns. Here is a live version you can use right on this page to analyze a potential brrrr deal.

BRRRR Calculator

Disclaimer: This calculator is for informational purposes. It should not be considered a substitute for financial advice. Localities have different rules, market aspects, and costs. Please consider working with a local professional to make sure you are getting accurate and up-to-date information specific to your area.

Need help analyzing your next BRRRR deal?

We offer personalized coaching and consulting for new real estate investors. Learn how we help clients use tools like this to build real ROI.

Frequently Asked Questions

Yes! While designed for single-family rentals, you can easily adapt this calculator for multifamily by adjusting the “Number of Units” and aggregating income and expenses. For short-term rentals, you would need to add categories for guest supplies and platform fees under operating expenses.

Absolutely. The Excel and Google Sheets versions are fully editable. You can add new expense lines, adjust percentages for refinancing, and tailor the entire sheet to fit the unique aspects of your investment strategy.

Regular repairs (like fixing a leaky faucet) should be logged under “Repairs and Maintenance.” Major upgrades that increase the property value (like a new roof or a full kitchen remodel) are considered capital expenses and should be tracked separately, as they are depreciated over time for tax purposes.

Want more resources like this? Explore all our free templates and spreadsheets, or read our full guide to analyzing your first rental property deal step-by-step.

About the Author

Joseph E. Stephenson, REALTOR®

License #00054082 | Kansas & Missouri

Affiliated with Welch & Company (License #CO00000477)

Joseph E. Stephenson is a licensed real estate professional in Kansas and Missouri with a career built on dedication to integrity and client-focused service. To learn more about how Joseph can assist you in your real estate endeavors, visit his REALTOR® profile at realtor.com.

Verify Joe’s Real Estate License Credentials

Real Estate Agent License VerificationVerify Joe’s Business Credentials

Joseph E. Stephenson also operates a business named Stephenson Residential, LLC. You can verify the business at the Kansas Secretary of State’s website.

Verify Business Credentials