Download our free, customizable rental property profit and loss statement template (Excel & Google Sheets). This tool helps you accurately track rental income, manage operating expenses, and calculate net operating income to see your property’s true financial performance.

Tracking your rental property finances is key to simplifying your business and focusing on growth. This profit and loss statement spreadsheet is designed to help you do just that. This tool will help you calculate gross income, net operating income, and your final net income after accounting for all operating expenses.

Download the Free P&L Spreadsheet

Who Should Use This P&L Template?

- New Landlords: Get a clear, simple system for tracking your finances from day one.

- Experienced Real Estate Investors: Quickly analyze the performance of new or existing properties.

- Property Managers: Create clean, professional financial statements for your clients.

- Agents Working with Investors: Provide tangible value to your clients by helping them run the numbers on a potential investment property.

How to Use This Excel Template

Here is how to make the most of this rental property profit and loss statement template.

- Download Your Preferred Version: Open the template in Excel or Google Sheets.

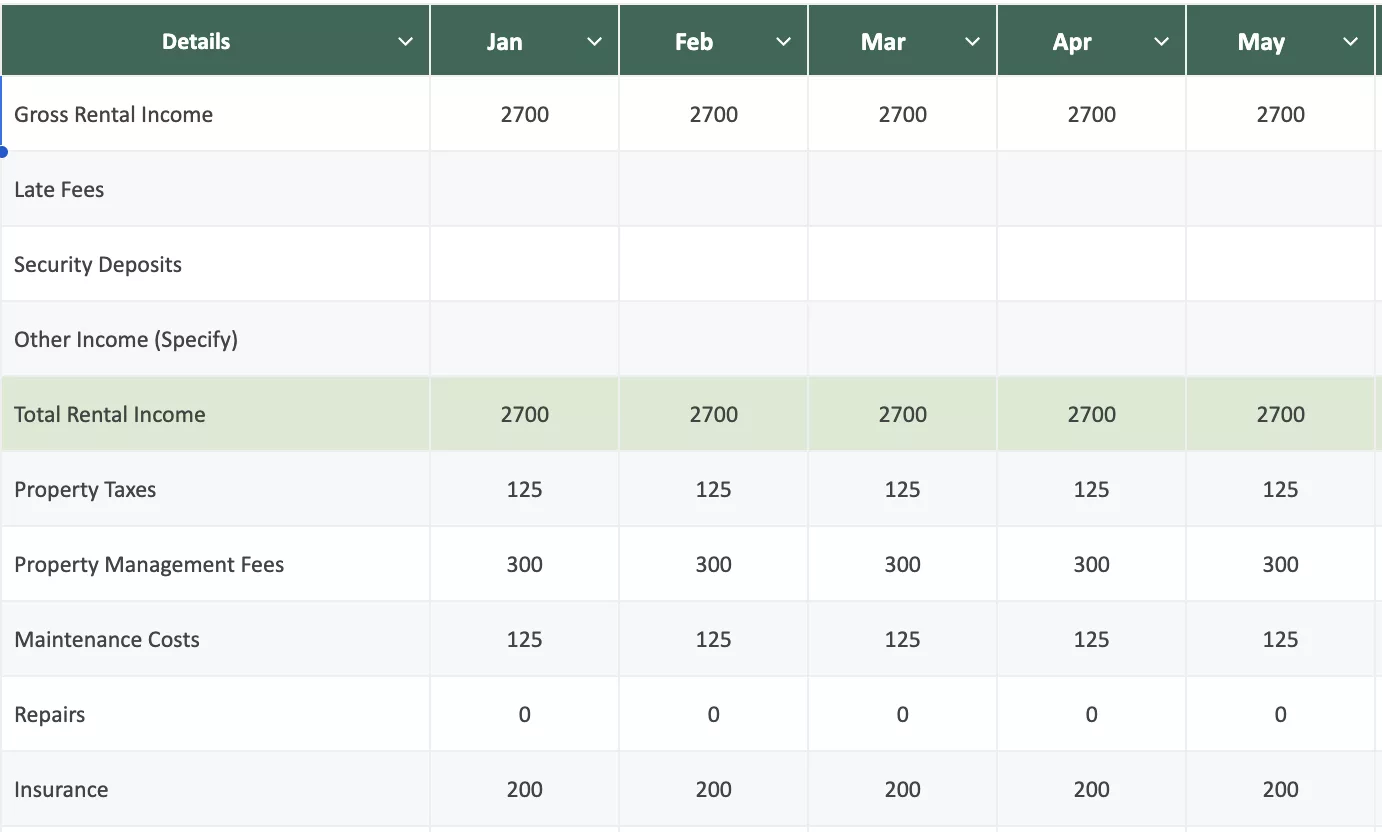

- Enter Your Monthly Income: Fill in your gross rental income, late fees, and any other income.

- Track Expenses with Precision: Add details for all your expenses, including property management fees, maintenance costs, and mortgage interest.

- Review Automated Totals: The template automatically calculates key metrics, including your operating expense ratio, net operating income, and total net income.

- Analyze Performance: Use the data to analyze your property’s financial performance and make informed decisions. A detailed P&L is also a crucial part of your rental property business plan.

What’s Included in This P&L Template?

This rental property income statement is pre-formatted with the essential categories you need to evaluate property profit and loss.

| Category | Sample Line Items |

|---|---|

| Revenue Streams | Gross Rental Income, Late Fees, Other Income (e.g., pet fees, laundry) |

| Operating Expenses | Property Taxes, Management Fees, Maintenance, Repairs, Insurance, Utilities |

| Profitability Metrics | Net Operating Income (NOI), Pre-Tax Net Income, Net Income, Cash Flow |

Excel vs. Google Sheets: Which is Better?

| Feature | Excel | Google Sheets |

|---|---|---|

| Accessibility | Offline access, powerful formulas. | Cloud-based, access from any device. |

| Collaboration | More difficult to share and co-edit. | Excellent for sharing with partners or accountants. |

| Best For | Detailed, complex financial modeling. | Quick analysis and easy sharing. |

Frequently Asked Questions

You should include all operating expenses, such as property taxes, insurance, property management fees, utilities, maintenance, and repairs. You should also include financing costs like mortgage interest. For a more detailed breakdown, use our Rental Property Expense Worksheet.

Yes, this template can be adapted for short-term rentals. You would need to add expense categories like “Guest Supplies,” “Cleaning/Turnover Costs,” and “Platform Fees.” Your monthly rental income will likely vary more than with a long-term lease.

Net Operating Income (NOI) is calculated by taking your total rental income and subtracting all of your operating expenses. This metric is crucial because it shows the property’s profitability *before* factoring in mortgage payments (debt service). Our spreadsheet calculates this for you.

Disclaimer: This worksheet is provided for informational purposes only and is not intended to serve as financial or tax advice. The calculation of the Operating Expense Ratio (OER) is a general guideline. Before making any financial decisions, consult with a qualified local professional, such as a financial advisor, certified tax professional, or accountant, for personalized advice.