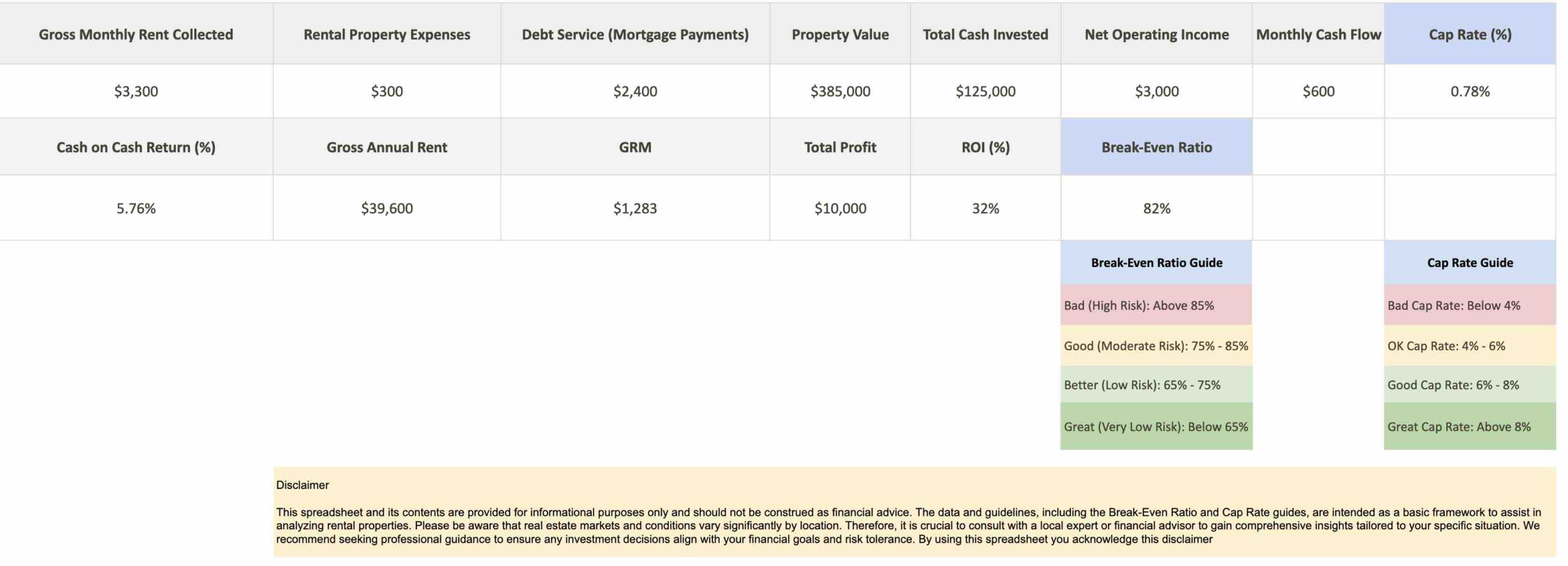

TL;DR: Looking for a fast way to analyze rental property deals? This free spreadsheet helps you estimate ROI, cap rate, cash flow, and expenses—just plug in property and loan info to get instant investment metrics.

When it comes to real estate investing, making informed decisions is everything. This free rental property analysis spreadsheet will help you calculate key financial metrics, analyze income statements, and determine a property’s fair market value with ease. It allows you to generate cash flow reports and prepare a comprehensive cash flow statement that provides real insights into the property’s profitability on both a monthly and annual basis.

Get the Free Analyzer – Excel & Google Sheets

Who Should Use This Spreadsheet?

- New Landlords: Perfect for evaluating your first rental property and understanding the numbers.

- Experienced Investors: A great tool for quickly comparing multiple multifamily or single-family units.

- Real Estate Agents: Use this to provide extra value and data-driven advice to your investor clients.

How to Use the Rental Property Analysis Spreadsheet

Investing in rental properties can be a great way to build wealth. This free real estate pro forma will help you master the numbers. Follow these steps to get started.

- Input Basic Property Details: Enter the address, property type, square footage, and year built.

- Add Purchase Information: List the purchase price, down payment, closing costs, and any renovation costs.

- Specify Financing Details: Input your loan amount, interest rate, and term to calculate your monthly mortgage payment.

- Estimate Rental Income: Enter the expected monthly rent and account for vacancy losses.

- Detail Operating Expenses: List all your operating costs, including property management fees, insurance, and maintenance.

- Analyze Profitability Metrics: The spreadsheet automatically calculates key metrics like your cap rate calculator, cash-on-cash return, and overall rental cash flow analysis.

If you’re buying a property… you need to know how to calculate the fifty percent rule. The fifty percent rule is a rule of thumb… it basically says that half of your income is going to go to your operating expenses, not including your mortgage.

0:00 hey everybody its Brandon so I was just 0:03 on the phone with a gentleman who was 0:04 looking to invest in Waco Texas and so 0:06 we were just talking about Waco a little 0:07 bit so I pulled up brildor.com 0:09 and I looked at the prices and I thought 0:11 hey it’s actually they’re not that bad 0:12 here and then I thought I’m gonna I’m 0:13 gonna when I got off the phone with them 0:14 I’m gonna run the numbers and just kind 0:16 of see what Waco looks like for a small 0:17 multi-family and then I thought hey why 0:19 don’t I record it and then put it on my 0:21 Instagram so other people can head and 0:22 see what I’m doing sound good so this Finding Properties 0:24 one I go and I went to a while 0:25 realtor.com it’s just one website to 0:28 find properties I typed in Waco Texas I 0:30 searched and I up here at the top I 0:32 chose property type multi-family let’s 0:35 do that and then I don’t want to see the 0:37 ones that are already pending or 0:39 continuing so I’m gonna hide pending and 0:41 contingent so now I’m left with just 0:43 properties and make Waco Texas that our 0:44 multi-family so we’ve got things from 0:46 753 35 to 39 kind of cool-looking 0:50 property 325 kind of all over the place 0:53 right 0:54 I like and then there’s this one on the 0:56 right side here and this is the first 0:58 one I have not analyzed it yet we’re 0:59 doing this live right now but I saw this 1:02 one and it said $280,000 and there’s 1:04 another one here on the left it looks 1:06 like and I thought this looks 1:08 interesting cuz of the two-car garage 1:09 typically this layout I like because 1:12 usually not always but many times the 1:15 water and the sewer is separated because 1:18 these are newer properties I mean this 1:19 was built in 2004 so chances are the 1:22 water meters are separate which means I 1:24 the landlord don’t pay water which is 1:26 always great for multifamily so I wanted 1:28 to analyze this deal and again I just 1:29 wanted to wait for you all to watch me 1:31 do it so there are no interior interior 1:33 pictures so I have to make some 1:34 assumptions today so please don’t go buy 1:36 this deal just because I analyzed it but 1:38 here that it says great opportunity and 1:40 cougar Ridge to get your own home cougar 1:43 Ridge it’s funny and investment property 1:44 at the same time this single-story brick 1:46 duplex features two three-bedroom 1:48 two-bath units located and coveted China 1:50 Springs is D so it must be like a 1:53 coveted coveted School District the 1:56 units feature open floor plans with 1:57 laundry hookups two-car garage fenced 1:59 backyard for residents to enjoy the lake 2:01 Waco Trail is just a short ride away and 2:03 provides a great way to relax you don’t 2:04 wanna miss your opportunity one of the 2:05 growing areas of Waco so I don’t know Rental Property Calculator 2:08 anymore Waco but this looks like an 2:10 interesting property around the numbers 2:11 on so is that alright can we do that 2:12 together 2:13 so uh yeah I’m gonna go over here to 2:16 bigger pockets come and click on tools 2:19 the navigation bar brings in the 2:20 calculators we’ve got like five main 2:22 calculators fix and flip rental bird 2:23 wholesaling and Rehab this is basically 2:26 a rental it’s already fixed up I’m 2:27 assuming so let’s go just basic the 2:30 rental property calculator for buy and 2:32 hold we’re gonna call it a title I’m 2:34 just gonna burn through this real quick 2:35 not explain everything that I’m doing 2:36 the Waco Texas duplex the address I’m 2:40 just gonna copy and paste the address so 2:42 in this case I already copied it into my 2:44 clipboard so there it is just doing some 2:47 basic copying and pasting at this point 2:49 everyone here should be able to do that 2:51 and taxes oh I don’t know what those are 2:54 well you know I’m gonna go over to 2:56 realtor.com I’m gonna figure it out so 2:58 if I scroll down realtor.com oftentimes 3:00 it’ll tell me there it is taxes about 3:02 six thousand dollars just just shy of 3:04 six thousand dollars so I’m gonna go and 3:06 go six thousand dollars on this one I 3:09 can add a photo you know why not I like 3:11 adding photos so it’s so add a photo in 3:13 there and select our file go to my 3:17 desktop there it is description I’m it’s 3:21 gonna put what the what the agent had 3:24 wrote here that’s good enough for me and 3:26 that’s it for page one let’s go to page 3:29 two what’s it what’s the purchase price 3:32 well let’s start with what they’re 3:33 asking 3:34 they’re asking two eighty two hundred 3:36 and eighty thousand dollars what’s it 3:39 worth when it’s all fixed up well it 3:40 probably is fixed up so let’s do that if 3:41 you don’t know how to find that hover 3:43 over the question marks closing costs 3:44 let’s call it $4,000 in closing costs 3:47 repair cost does that need any repairs 3:49 there’s always something let’s call it 3:50 $2,000 I don’t actually know and I’m 3:53 gonna put down a 20% down payment loan 3:55 at four point we’ll play four point five 3:57 percent interest 3:59 I’m gonna go amortize on a 30-year loan 4:01 I’m not gonna do the other ones for now 4:03 just to keep this quick and dirty now 4:04 what about what are these units rent for 4:06 well I’m gonna go over to rent ometer 4:07 let’s go to rent ometer that’s a site 4:08 that I use for quick and dirty numbers 4:10 and let’s put in the address here and 4:14 let’s see what they say on rent domitor 4:16 for a is like twelve hundred I’m 4:19 wondering twelve hundred for a 4:21 three-bedroom house or duplex is that 4:24 appropriate well let’s find out in this 4:26 neighborhood so 4:27 according to rent ometer I just guessed 4:28 at it but 1283 is average median is 1350 4:32 so we could potentially get up to a 4:34 $1,350 that’s good to know in fact a 4:37 four-bedroom is up to sixteen fifty 4:40 three which is crazy that’s good so this 4:41 is a high rent area I’m down below that 4:44 I can look at some of the other 4:44 properties to kind of see like you know 4:46 how similar those are to mine but for 4:49 quick and dirty right now let’s go 1,300 4:51 I’m gonna go a little higher than the 4:52 average because this is probably gonna 4:53 be a little nicer and it’s got that you 4:56 know the two-car garage and all that but 4:58 I’m not gonna go quite median so let’s 4:59 go 1,300 to keep it conservative right 5:01 now let’s find my where’s my there it is 5:06 so let’s go unit breakdown at a unit a 5:09 at a unit B and go 1,300 each does the 5:13 listing say sometimes the listing will 5:15 say what they’ll what their current rent 5:16 is yeah it doesn’t really say that’s 5:19 okay let’s see go back over here well 5:23 there any other income is there like 5:24 laundry income or anything like that 5:26 probably not now remember I said earlier 5:28 the reason I like side-by-side duplex is 5:30 typically I think I said this earlier if 5:32 not the reason I like side-by-side 5:33 duplex is actually newer ones is usually 5:36 the water and sewer lines are separated 5:38 I’m gonna assume that’s the case here 5:39 that the water and sewer lines are 5:41 separated and I’m gonna go ahead and 5:42 just say that each tenant will pay their 5:44 own electricity the tenants will pay 5:45 their own water sewer and garbage I 5:47 minutes to pay insurance probably gonna 5:49 run me about $800 a month and then I’m I 5:52 may in this case I probably won’t 5:55 sometimes on duplexes you have to do the 5:57 lawn care but because they have their 5:59 own garages and because they have their 6:01 own yards I’m gonna make them 6:02 responsible for their own lawn care so I 6:04 don’t worry about that either 6:05 now vacancy I usually do around 5% 6:08 repairs and maintenance anywhere between 6:09 five and ten depent so five percent of 6:13 the rent to ten percent of the rent 6:14 depending on the age of the home now 6:16 there’s a newer property so I’m gonna go 6:18 five percent same thing for capex this 6:20 is like big-ticket items were gonna save 6:22 up for a new roof every 20 years new you 6:25 know plumbing every 40 years new windows 6:27 every 30 years new appliances every ten 6:29 years capex is just saving up for those 6:31 items I’m at higher property manager 10% 6:33 to manage the rent of that one and then 6:36 I’m going to assume that we’re gonna 6:37 grow by let’s call it two percent income 6:40 growth 6:40 2% property value growth 2% expense 6:42 growth and someday when I sell the 6:44 property I got to pay real estate agent 6:46 in closing costs that’s sales expenses 6:48 someday let’s calculate the results and 6:50 find out what happens here we go five 6:53 four three two I have no idea my guess 6:56 is it’s not gonna be a very good deal as 6:57 is but what I got like I always say 6:59 every property has a number that could 7:01 make it a good deal every property other 7:03 number that could make it a good deal 7:04 let’s find out so here we go based on Analysis 7:06 our numbers we just ran monthly income 7:08 of twenty six hundred a month month 7:10 expenses 23 eighty four which means our 7:13 cash flow our estimated cash flows two 7:15 hundred and fifteen bucks a month not 7:17 terrible if you if you recall from my 7:19 criteria thing the other day I said I 7:21 want to get at least a hundred dollars 7:23 per month per unit is my like baseline 7:26 well two fifteen qualifies but remember 7:29 my cash on cash return percentage I’ve 7:31 said it twice now on Instagram lately 7:33 I want a twelve percent return I am NOT 7:36 anywhere close to twelve percent so you 7:37 know I’m gonna do I’m gonna start crying 7:40 and say there’s no good deals in my 7:41 market and go back to watch The Bachelor 7:42 cuz I think that starts soon right after 7:44 Dancing with the Stars gets done by guys 7:47 kidding of course every number every 7:50 property has the number so let’s find it 7:52 edit report let’s find another number 7:54 instead of paying 280 for this property 7:56 what if we were to pay 280 let’s what we 7:59 were to pay 230 let’s go crazy 230 now I 8:02 know people are saying they’re not gonna 8:03 take a 50 thousand dollar discount 8:05 probably not you never know right and 8:07 this also shows why off-market deals are 8:09 usually better let’s check it out though 8:10 check this out at 2:30 we’re still only 8:13 at a nine point six percent cash on cash 8:15 return but our cash flows bump to 417 so 8:19 we’re getting closer now if I was 8:21 getting a $50,000 discount I might be 8:24 okay with a 10% return so we’re probably 8:25 getting close let’s go let’s jump it 8:28 even more so this property let’s go down 8:31 to 210 again I doubt they’re gonna take 8:33 that but it’s worth running the numbers 8:35 and finding out it’s also why I like the 8:37 burst strategy cuz BRR you can usually 8:39 get better deals but just I turnkey you 8:41 duplex like this now at 210 I’m at the 8:44 twelve point four seven so I’m probably 8:45 out like a 220 now they’re asking 280 8:49 I’m probably around a 220 to make this 8:51 deal worthwhile now granted if I 8:54 believe that this market is gonna 8:55 appreciate really really hot then maybe 8:56 I would have I would have accepted a 8:58 lower cash in cash return maybe or you 9:02 know maybe other reasons but looking at 9:03 this chart like year 1 2 5 10 15 20 I 9:06 mean if I bought this property at two 9:09 hundred and ten thousand held on to it 9:10 for 15 years look how much profit I’d 9:13 have if I sold it over the course of 9:14 those 15 years three hundred grand in 9:16 profit is a fourteen point three five 9:18 percent return I can see my equity 9:20 climbing I can see my loan getting paid 9:22 off I can see my property value going up 9:23 over time I see my cash flow going up 9:26 every year hopefully so I’m making about 9:28 six grand a year from year one that 9:30 comes at almost seventy three hundred by 9:31 year five by year 10 off to nine 9:33 thousand so you can see it going up over 9:35 time so I know I just kind of a cool way 9:38 to look at the deal so this deal to me 9:39 this duplex I’d probably pay somewhere 9:42 in the 220 230 maybe 240 range you know 9:46 a maybe except in a slightly lower cash 9:48 in cash return but maybe you’re fine 9:50 with it maybe you’re good with a 5% 9:51 return and you can pay the full 280 I 9:53 don’t know I’m not gonna tell you what 9:54 to do what not to do but the one final 9:57 thing you can also download if you don’t 9:58 know this with the BP calculators anyway 10:00 you can download a PDF report like this 10:03 and it shows you all those numbers 10:05 nicely and neatly so that you can show a 10:07 lender portfolio lender a hard money 10:10 lender your spouse you can show anybody 10:13 you want your partners that you’ve done 10:14 your homework and this makes me feel 10:16 really good so when I before I make an 10:18 offer on a property I like to do this so 10:19 there you go that is how I run the 10:22 numbers quickly and efficiently and 10:24 easily and accurately on rental 10:26 properties and so it looks like in Waco 10:28 you know it’s not the end of the world 10:31 they probably would say no but that’s 10:32 why this is just a numbers game it’s 10:34 just a numbers game so I might make an 10:36 offer on this property and they’ll 10:37 probably say no but later on maybe 10:39 they’ll say yes if I offered on it maybe 10:40 this has been sitting on the market a 10:41 while or maybe I need to find a 10:43 fixer-upper so I can build that equity 10:45 in and get my cash in cash return higher 10:47 because I’m going to do the Bur strategy 10:49 I don’t know anyway if this was helpful Outro 10:51 make sure you give that little thumbs up 10:52 button or a little heart button below 10:53 this video whatever I do and follow me 10:56 follow us at bigger pockets everywhere 10:58 follow me personally on Instagram have 11:00 beardy brandon if you’re not and I’m 11:02 gonna get out of here cuz my little girl 11:03 just made some snickerdoodle cookies and 11:05 she’s making me a heart-shaped one 11:07 because 11:07 she loves me thank you so much you guys 11:09 have a great day

Rental Property Spreadsheet FAQs

A common way to measure return on investment is the Cash-on-Cash Return. It’s calculated by dividing your annual pre-tax cash flow by the total amount of cash you invested. Our spreadsheet calculates this for you automatically.

Both are excellent tools. Excel is powerful for offline use, while Google Sheets allows for easy collaboration and access from any device. We offer this template in both formats so you can choose what works best for your workflow.

At a minimum, your analysis should include Net Operating Income (NOI), Cap Rate, and Cash-on-Cash Return. You should also track gross rental income, all operating expenses, and your monthly mortgage payment to get a complete picture of the investment’s performance.

Check Back for Updates

I’m interested in always improving my rental property analysis spreadsheet free to make it more useful and insightful for investors like me. Having said that, I absolutely am interested in your feedback. I constantly research best practices and add features to help analyze property value and project future appreciation potential with precision. The latest updates allow me to break down gross annual rental income, gross monthly rent collected, and even calculate net annual cash flow with ease.

I’ve included details for tracking property management fees and outlining gross monthly rent, while also incorporating tools for comparative market analysis and summarizing gross annual rent. Using the spreadsheet, I can manage monthly rental income, factor in personal income tax and property taxes, and even analyze costs and gains over the entire holding period. These updates are designed to generate greater cash flow and provide insights into effective gross rental income, verifying that decisions are backed by data. Be sure to check back regularly as I keep adding features to make it even better.

About the Author

Joseph E. Stephenson, REALTOR®

License #00054082 | Kansas & Missouri

Affiliated with Welch & Company (License #CO00000477)

Joseph E. Stephenson is a licensed real estate professional in Kansas and Missouri with a career built on dedication to integrity and client-focused service. To learn more about how Joseph can assist you in your real estate endeavors, visit his REALTOR® profile at realtor.com.

Verify Joe’s Real Estate License Credentials

Real Estate Agent License VerificationVerify Joe’s Business Credentials

Joseph E. Stephenson also operates a business named Stephenson Residential, LLC. You can verify the business at the Kansas Secretary of State’s website.

Verify Business Credentials