Download a Free Rental Property Analysis Spreadsheet and Calculator

(Updated April 2025)

Download This Spreadsheet

Excel | PDF | CSV | Google Sheet

Connect, share, and grow with like-minded individuals. Don’t miss out on the excitement!

Rental Analysis Calculator in Excel, Free to Download

According to the Consumer Price Index (CPI) Housing Survey by the Bureau of Labor Statistics (BLS), 59.6% of leases in the U.S. are for 12 months, while 31.8% are month-to-month. This underscores how crucial it is to understand lease terms when analyzing rental property cash flow.

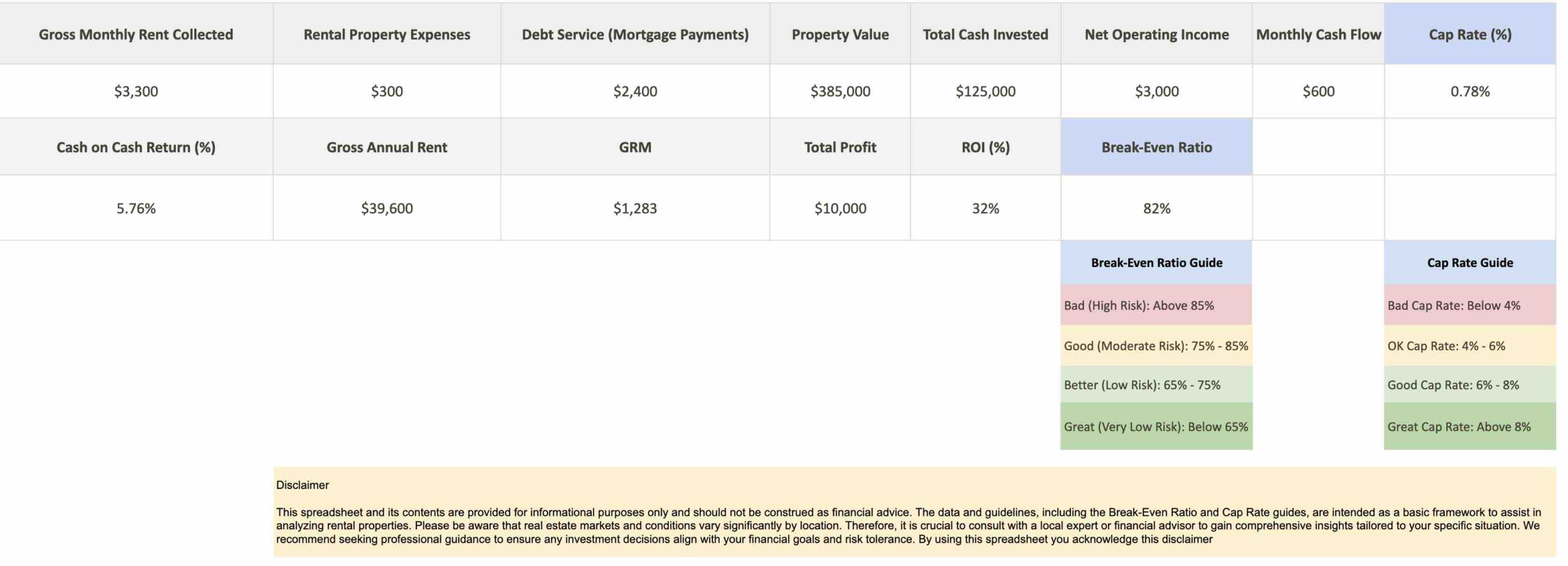

Over the years, I have found that when it comes to real estate investing, making informed decisions is everything for building wealth in the long term. I like to rely on my rental property analysis spreadsheet; it’s free and makes the process easier to analyze. This tool, built on Google Sheets, has transformed the way I evaluate properties. It allows me to calculate key financial metrics, analyze income statements, and determine a property’s fair market value with ease.

One of the things I appreciate most is how it helps me break down operating costs and account for other expenses like repairs, management fees, and taxes. With these details, I now can generate cash flow reports and prepare a comprehensive cash flow statement that provides real insights into the property’s profitability on both a monthly and annual basis.

The spreadsheet even simplifies tracking monthly operating expenses, which I know can get overwhelming without the right tools. It’s particularly built to help me create income statements and identify other financial metrics that I may or may not have overlooked. I may be projecting future appreciation or honing in on other key financial metrics, and this tool pulls it all together, giving me a complete picture of the property’s performance.

For anyone in real estate investing, even if you’re just starting out or building your portfolio, the clarity this spreadsheet offers is invaluable. I think you should strive to continue making confident, data-driven analysis and decisions that set you up for success.

Plan, Analyze, Succeed

From first-time purchases to large-scale portfolios, the Rental Analysis Calculator is designed to guide real estate investors toward financial success. Understand every aspect of your rental properties, down to future expenses and appreciation forecasts, you’re positioned to make savvy investment decisions that align with your goals. With this calculator, every real estate deal becomes more transparent, measurable, and profitable. Start optimizing your investments today with this indispensable tool.

Input the Rental Property Data

| Category | Details |

|---|---|

| Property Details | Enter Address, Type of Property, Year Built, Square Footage, Number of Units. |

| Purchase Information | List Purchase Price, Down Payment, Closing Costs, Renovation Costs. Calculate Total Investment. Example: Total Investment = Purchase Price + Down Payment + Closing Costs + Renovation Costs |

| Financing Details | Specify Loan Amount, Interest Rate, Loan Term. Calculate Monthly Mortgage Payment. Example: Monthly Mortgage = (Loan Amount * Interest Rate) / (1 – (1 + Interest Rate)^(-Loan Term)) |

| Rental Income | Input Monthly Rent, Vacancy Loss (%), Other Income. Calculate Gross Rental Income. Example: Gross Rental Income = (Monthly Rent * (1 – Vacancy Loss)) + Other Income |

| Operating Expenses | Detail Property Taxes, Insurance, Utilities, Management Fees, Maintenance, HOA Fees, Marketing, Legal Fees. Sum these expenses for total Operating Expenses. |

| Cash Flow Analysis | Calculate Gross Operating Income, Net Operating Income, Cash Flow Before Taxes, Cash Flow After Taxes. Example: Net Operating Income = Gross Rental Income – Operating Expenses. Cash Flow Before Taxes = Net Operating Income – Mortgage Payment. |

| Profitability and Return Metrics | Determine Cap Rate, Cash on Cash Return, Internal Rate of Return, Return on Investment. Example: Cap Rate = (Net Operating Income / Purchase Price) * 100. Cash on Cash Return = (Annual Cash Flow / Total Investment) * 100. |

| Market Analysis | Research Comparable Rental Rates, Area Vacancy Rates, Economic Indicators. |

| Future Projections | Estimate Appreciation Rate, Rent Increase Rate, Long-Term Expenses. |

Pros and Cons Template

My Pros and Cons Rental Property Analysis Spreadsheet

| Property Details | Pros | Cons |

|---|---|---|

| Location | Central location, close to amenities | Busy street, might be noisy |

| Size | Spacious, 3 bedrooms | More maintenance required |

| Price | Below market value | Potential hidden costs |

Download This Spreadsheet

Excel | PDF | CSV | Google Sheet

How to Use My Rental Property Analysis Spreadsheet

We all know that investing in rental properties can be a great way to generate income and thus build your wealth. This is where a a free tool like this rental property analysis spreadsheet becomes invaluable. If you think you need help learning about the intricacies of these analyses, I can help. I am a passionate real estate agent with a love for discussing rental properties as investments.

Step-by-Step Guide For the Spreadsheet

Start by Inputting Basic Property Details

Step 1 – Enter the essential details of the property, such as the address, type, square footage, and the year it was built. These basic details set the foundation for a more in-depth analysis.

Purchase Information

Step 2 – list the purchase price, down payment, closing costs, and renovation costs in the designated sections. The spreadsheet will automatically calculate your total investment, giving you a clear picture of your upfront costs.

Financing Details

Step 3 – For those financing the purchase, specify your loan amount, interest rate, and loan term. The spreadsheet will then compute your monthly mortgage payment, which is vital for understanding your ongoing expenses.

Rental Income Estimation

Step 4 – Here, you’ll input the expected monthly rental income, account for vacancy losses, and add any other income sources. The result is your gross rental income, a key figure in evaluating the property’s revenue-generating potential.

Operating Expenses and Cash Flow Analysis

Step 5 – Detail your operating expenses, including property management fees, insurance premiums, and maintenance costs. The spreadsheet will sum these to provide your net operating income. Subtracting the mortgage payment from this gives you your cash flow before taxes, a critical measure of the property’s financial health.

Profitability and Return Metrics

Step 6 – The spreadsheet helps you calculate important financial metrics like cap rate and cash on cash return. These figures are essential in assessing the investment’s potential return.

Why This Spreadsheet Is Helpful

Using this spreadsheet allows investors to systematically evaluate a rental property’s financial prospects. It helps to verify that no expense or income stream are being overlooked, providing a comprehensive overview of potential profitability. Estimate key metrics such as net operating income and cash flow, investors can make informed decisions.

Considerations When Analyzing a Property

When using the spreadsheet, think about the long-term aspects, like market value trends, potential equity gains, and future appreciation. Also, consider operating expenses and how they might increase over time.

I like to reflect on the local real estate market, including comparative market analysis, to estimate fair market rents accurately.

I’d like to emphasize the importance of considering the entire holding period of the investment, not just the immediate cash flow. My personal advice for investors to look at is potential cash flow improvements, such as minor updates that could allow for greater rent charges.

How Can I Assist?

If you find yourself overwhelmed by the analysis or have questions about specific entries, Joe Stephenson is eager to assist. With his expertise in rental property investments and deep knowledge of real estate markets, he can provide insights into optimizing your investment strategy.

I think my guidance can be invaluable for helping people determining the current market’s rents, forecasting operating expenses, or evaluating the potential for equity gains. I understand that every investor’s goals and situations are unique.

Many people like to say he takes the time to discuss your investment objectives, helping you tailor the analysis to meet your needs. My enthusiasm for real estate investment makes this platform an excellent resource for both seasoned and novice investors.

Important Terms to Know and Remember

| Term | Description |

|---|---|

| Personal Income Tax | This is the tax levied on an individual’s earnings from wages, investments, and other sources. |

| Gross Annual Rental Income | This is the total income generated from a property before any expenses are deducted, calculated on a yearly basis. |

| Gross Monthly Rent Collected | Gross monthly rent collected is the total amount of rent money received from tenants each month before expenses. |

| Net Annual Cash Flow | The amount of money left over after all operating expenses and financing costs have been paid, calculated annually. |

| Property Cash Flow | The difference between the rental income generated by a property and its operational costs. |

| Effective Gross Rental Income | The adjusted gross income after accounting for vacancy losses and additional income from property-related services. |

| Repair and Maintenance Costs | Expenses incurred to keep the property in good condition and maintain its value. |

| Greater Cash Flow | A situation where a property’s income exceeds its expenses, resulting in positive cash flow. |

| Fair Market Value | The estimated price at which a property would sell under current market conditions. |

| Determine Market Rents | The process of evaluating the rental rate a property could realistically command in the open market. |

| Leasing Fees | Charges associated with securing tenants for the property, typically paid to a property manager or leasing agent. |

| Mortgage Debt Service | The cost of servicing the debt on a property, including principal and interest payments on the mortgage. |

| Median Sales Prices | The middle value in a list of sales prices for properties sold in a particular area, indicating the central market value. |

| Gross Annual Rent | The total amount of rent collected over a year without deducting any expenses or vacancies. |

Check Back for Updates

I’m interested in always improving my rental property analysis spreadsheet free to make it more useful and insightful for investors like me. Having said that, I absolutely am interested in your feedback. I constantly research best practices and add features to help analyze property value and project future appreciation potential with precision. The latest updates allow me to break down gross annual rental income, gross monthly rent collected, and even calculate net annual cash flow with ease.

I’ve included details for tracking property management fees and outlining gross monthly rent, while also incorporating tools for comparative market analysis and summarizing gross annual rent. Using the spreadsheet, I can manage monthly rental income, factor in personal income tax and property taxes, and even analyze costs and gains over the entire holding period. These updates are designed to generate greater cash flow and provide insights into effective gross rental income, verifying that decisions are backed by data. Be sure to check back regularly as I keep adding features to make it even better.

Contact Joe. Join Our Newsletter.

Stay informed about the latest trends and tips in real estate by joining our newsletter. A rental property analysis spreadsheet is a powerful tool for anyone considering real estate investment. It offers a structured approach to evaluating the profitability and financial health of potential rental properties.

For those seeking personalized advice or assistance with their analysis, I hope you find my approach very knowledgeable and passionate professional ready to help. With the right tools and expert advice, making informed investment decisions has never been easier.

About the Author

Joseph E. Stephenson, REALTOR®

License #00054082 | Kansas & Missouri

Affiliated with Welch & Company (License #CO00000477)

Joseph E. Stephenson is a licensed real estate professional in Kansas and Missouri with a career built on dedication to integrity and client-focused service. To learn more about how Joseph can assist you in your real estate endeavors, visit his REALTOR® profile at realtor.com.

Verify Joe’s Real Estate License Credentials

Real Estate Agent License VerificationVerify Joe’s Business Credentials

Joseph E. Stephenson also operates a business named Stephenson Residential, LLC. You can verify the business at the Kansas Secretary of State’s website.

Verify Business Credentials